As of March 31, 2025, SBI Investment has established private funds totaling JPY159B with 21companies. SBI Investment is actively conducting investment activities and supporting alliance development, aiming at creating business synergies between large companies and startups.

Open Innovation

Creating New Businesses through Open innovation

Amid increasing global competition over innovation, instead of traditional self-reliance, open innovation that actively acquires expertise and technologies from outside sources has been attracting attention.

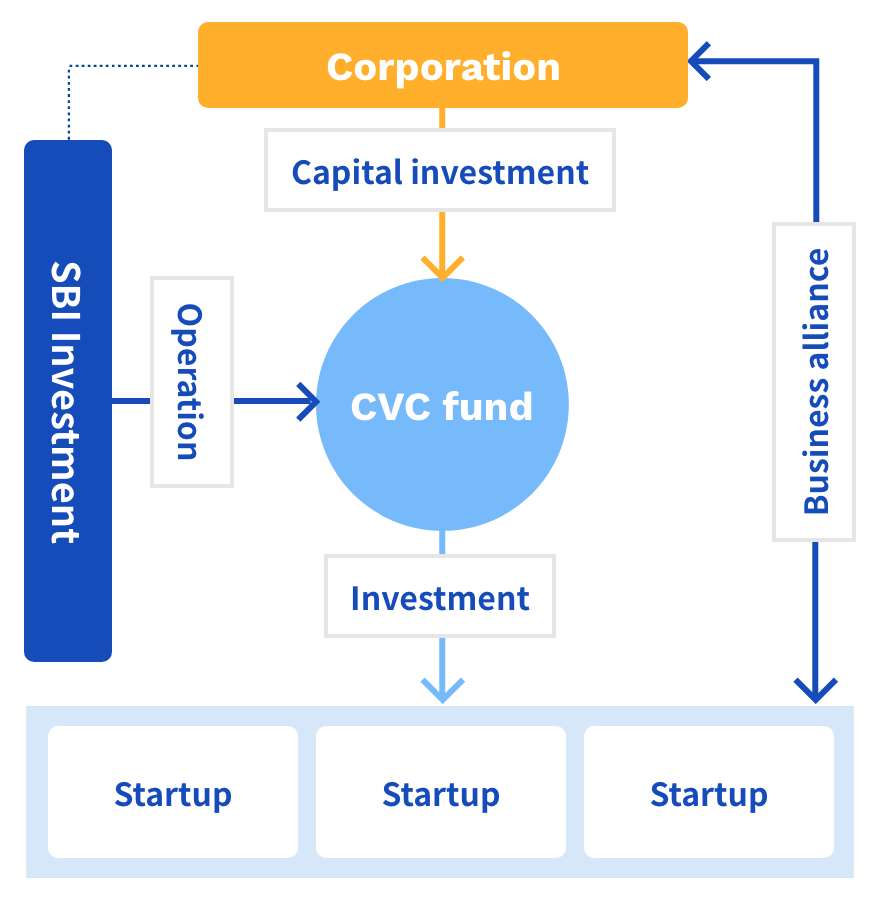

SBI Investment is engaged in the creation of new businesses through the management of CVC funds and the matching of fund investors with investees.

Corporate Venture Capital (CVC) Business

Through the management of CVC funds, SBI Investment provides comprehensive support for business investments by operating companies in each phase of investment, i.e. venture identification, investment review, investment execution, monitoring, and realization of business synergies. We support the enhancement of our CVC fund portfolio companies’ corporate value by leveraging our expertise developed through our “Full Hands-on Support” to address their challenges.

-

01Startup sourcing

Extensive network

Leveraging extensive networks to help corporations identify ventures matching their needs

-

02Investment review

Corporate evaluation functions

Conducting multifaceted evaluation of investment candidates by using venture evaluation know-hows

-

03Investment execution and monitoring

Investment/corporate management functions

Smoothly executing investments by negotiating and signing contracts with investees. Monitoring corporate management

-

04Creation of business synergies

Business synergy support functions

Providing liaison functions to ensure smooth creation of business synergies between corporations and investees.

CVC Funds Under Management

この表は横にスクロールできます

| CVC Partner | Fund Name | Period | Committed Capital | |

|---|---|---|---|---|

|

Nikon Corporation | Nikon-SBI Innovation Fund | From July 2016 | JPY10B |

| Nikon-SBI Innovation Fund II | From November 2023 | JPY5B | ||

|

INTAGE Holdings Inc. | INTAGE Open Innovation Fund | From October 2016 | JPY5B |

|

Mitsui Mining & Smelting Co., Ltd. | Mitsui Kinzoku-SBI Material Innovation Fund | From September 2017 | JPY5B |

| Mitsui Kinzoku-SBI Material Innovation Fund II | From January 2025 | JPY5B | ||

|

House Foods Group Inc. | House Foods Group-SBI Innovation Fund | From October 2017 | JPY5B |

| House Foods Group-SBI Innovation Ⅱ Investment LPS | From January 2023 | JPY5B | ||

|

Tokyu Fudosan Holdings Corporation | TSVF1 Investment LPS | From October 2017 | JPY5B |

| TSVF2 Investment Limited Partnership | From January 2025 | JPY5B | ||

|

SUBARU Corporation | SUBARU-SBI Innovation Fund | From July 2018 | JPY10B |

|

FUSO GROUP Holdings Inc. | FUSO-SBI Innovation Fund | From March 2020 | JPY5B |

|

dip Corporation | DIP Labor Force Solution Fund | From March 2020 | JPY9B |

|

Sumitomo Mitsui Trust Bank, Limited | SuMi TRUST Innovation Fund | From September 2020 | JPY5B |

|

Sumitomo Life Insurance Company | SUMISEI INNOVATION FUND | From November 2020 | JPY8B |

|

Medipal Holdings Corporation | MEDIPAL Innovation Fund | From March 2021 | JPY10B |

|

Hankyu Hanshin Holdings, Inc | Hankyu Hanshin Innovation Partners Investment LPS | From April 2021 | JPY3B |

|

Restar Holdings Corporation | Restar-SBI Innovation Fund Investment Limited Partnership | From July 2021 | JPY5B |

|

KDDI CORPORATION | KDDI Green Partners Fund | From November 2021 | JPY5B |

|

Panasonic Corporation | Panasonic Kurashi Visionary Fund | From July 2022 | JPY8B |

|

PARAMOUNT BED CO., LTD. | PARAMOUNT BED-SBI Healthcare Fund I Investment Limited Partnership | From September 2022 | JPY5B |

|

NIPPON EXPRESS HOLDINGS, INC. | NX GLOBAL INNOVATION FUND | From January 2023 | JPY5B |

|

MatsukiyoCocokara & Co. | MC&C Investment Limited Partnership | From April 2023 | JPY5B |

|

Ricoh Company, Ltd. | RICOH Innovation Fund No.1 Investment Limited Partnership | From November 2023 | JPY5B |

|

Fukuoka Financial Group, Inc. | FFG Strategy No.2 Investment Limited Partnership | From July 2025 | JPY3B |

|

SANKYU INC. | SANKYU-SBI Innovation Fund No.1 Investment Limited Partnership | From September 2025 | JPY5B |

* There are two other funds (committed capital: JPY18B)

Examples of Business Collaboration Utilizing CVCs

Nikon and Exvision

With the investment in Exvision by the Nikon-SBI Innovation Fund, Nikon and Exvision have been collaborating on the development of Nikon's next-generation project in the materials processing business.

By collaborating with Exvision, which has strengths in high-speed image processing hardware and software and a large number of talented engineers, Nikon has developed high-precision metal removal processing machines and Riblet processing services that feature microfabrication.

In August 2021, Nikon acquired Exvision and made it a subsidiary.

INTAGE Group and Research and Innovation

Based on bar codes, INTAGE Group's Product Master, utilizes the businesses of both companies through an originally-defined database of product information and attributes (characteristics), and Research and Innovation's receipt and name-based Product Master developed via a purchase data registration app called CODE.

House Foods Group and SARAH

SARAH started a food-service big data business by leveraging its abundant word-of-mouth data per menu, which are unavailable on existing gourmet sites. The House Foods Group entered into a capital and business alliance with SARAH in an aim to leverage SARAH's big data for developing commercial food products for dinner and home-meal replacement, as well as for strengthening sales.

SUBARU×AEye, Inc

SUBARU believes that it is essential to take on the challenge of new businesses

and technologies, and has established the SUBARU-SBI Innovation Fund as a

mechanism for gathering knowledge actively from outside the company and combining it with internal knowledge to create innovation. SUBARU invested in AEye, Inc., a company that develops and provides sensing systems capable of detecting dynamic objects by combining laser scanners (LiDAR) and cameras.

AEye, Inc. got listed on the NASDAQ via a merger with special purpose acquisition company(SPAC) on August 18, 2021.

CVC Partner Interview

Major investors of our funds

Over 200 wide-ranging investors, including over 70 local financial institutions, major financial institutions, and corporations, have invested in funds being operated by SBI Investment.

Examples of how our funds contribute to LP investors and startups

Taiyo Holdings and Cyfuse

Taiyo Holdings entered into a capital and business alliance with Cyfuse Biomedical K.K., allowing both companies to make progress in building cell product manufacturing facilities and developing cell products. Thus, Taiyo Holdings can move into regenerative medicine and cell medicine areas, thereby expanding and strengthening the medical and pharmaceutical business.

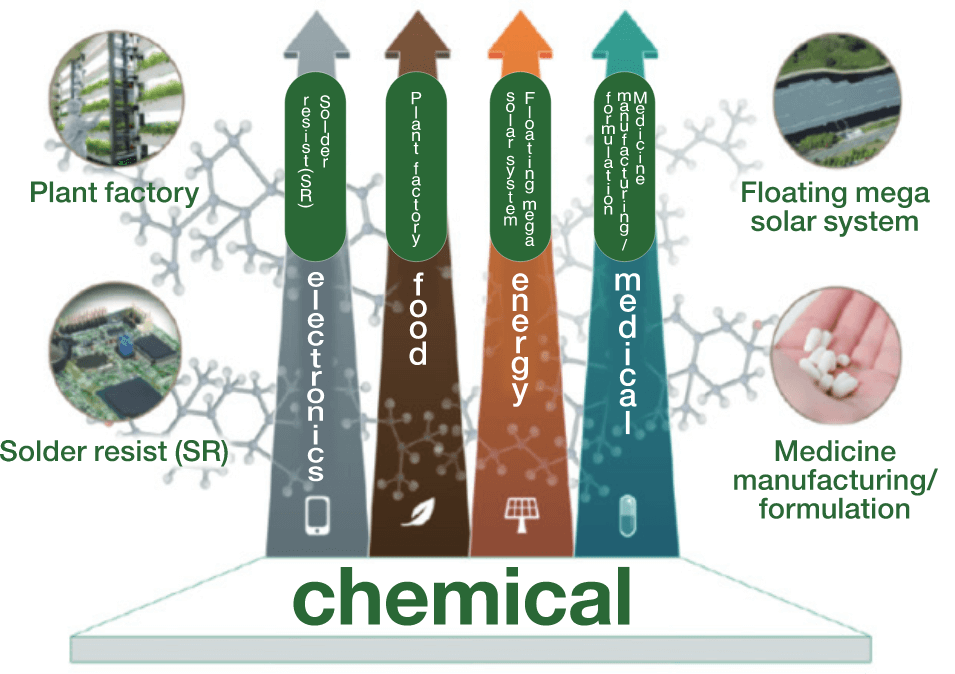

Taiyo Holdings

Medium-Term Management Plan "NEXT STAGE 2020"

- ・Taiyo aims to extricate itself from a business structure that is heavily dependent on the printed wiring board (PWB) component business, and evolve into a comprehensive chemical company underpinned by a key word "chemical" of the Taiyo Group.

- ・Taiyo promotes the creation of new businesses in four fields where a future growth is expected, which are medical and pharmaceuticals, foods and energy, in addition to electronics (including solder resist).

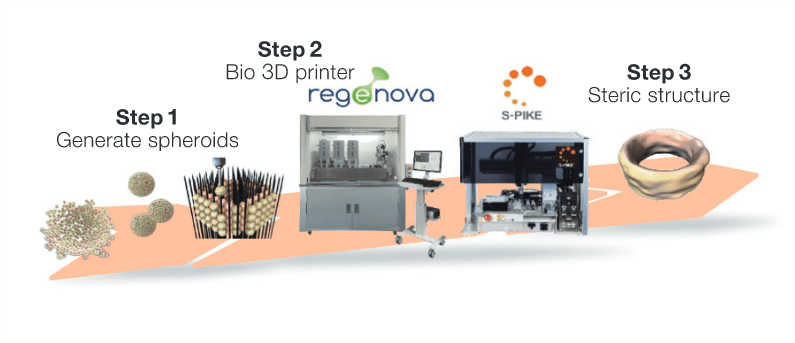

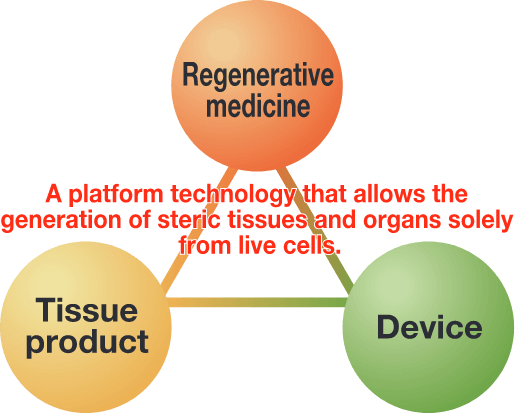

Cyfuse

A regenerative medicine venture company founded in 2010 for the benefit of patients by contributing to the regeneration of their body tissues and organs which have become dysfunctional due to diseases and injuries.

Cyfuse aims to commercialize epoch-making cell products with the use of an innovative platform for generating steric tissues and organs solely from live cells, promoting research and development in the regenerative and tissue medicine area.