01AI Sector

Advances in AI technologies such as big data and deep learning have greatly improved the accuracy of identification and forecasting. AI, such as voice recognition, image searching, and autonomous driving, is becoming an increasingly familiar aspect of people’s day-to-day lives. Regardless of industry or type of business, in order for companies to maintain and improve their competitiveness, efforts must be made in AI.

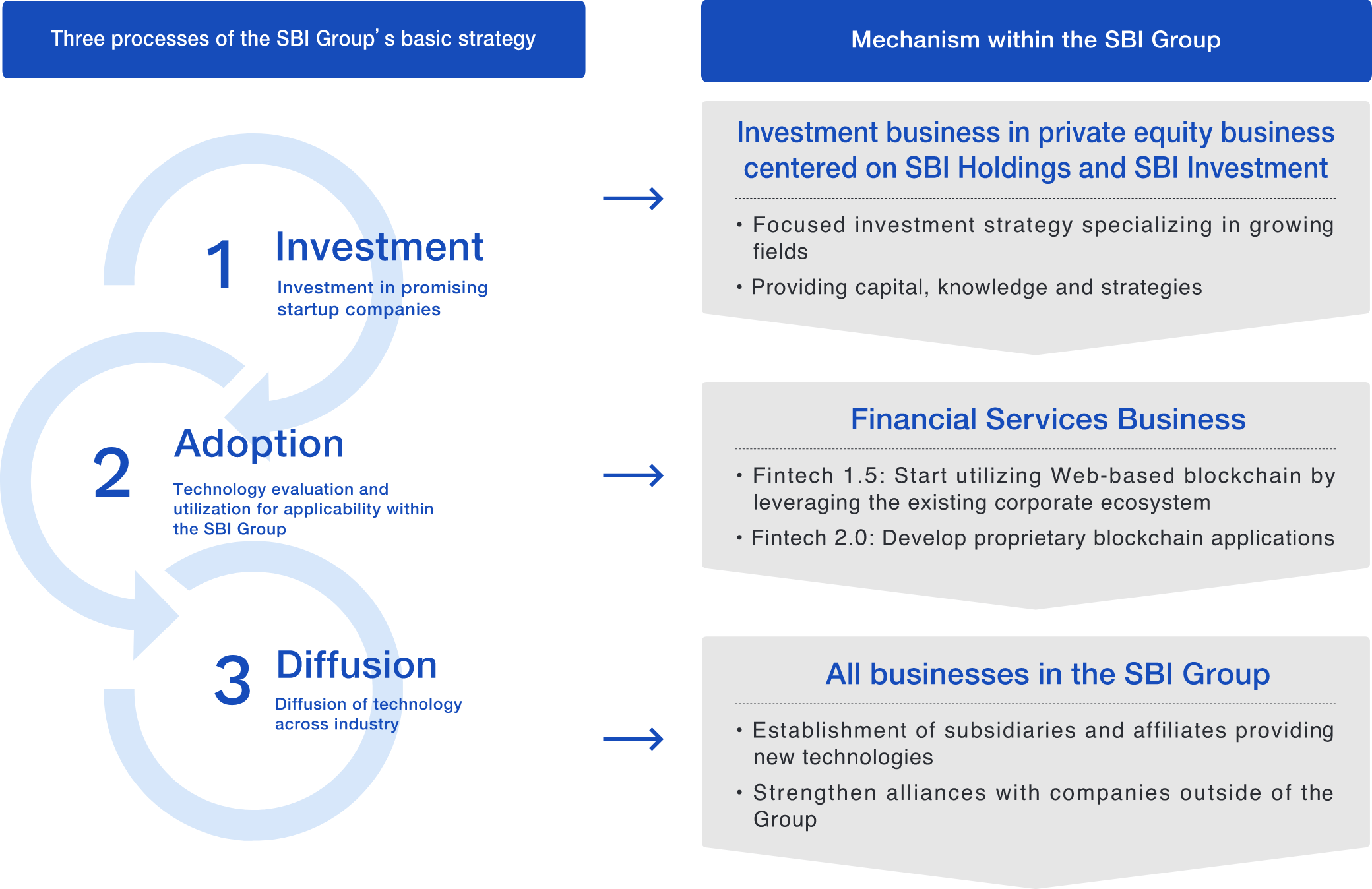

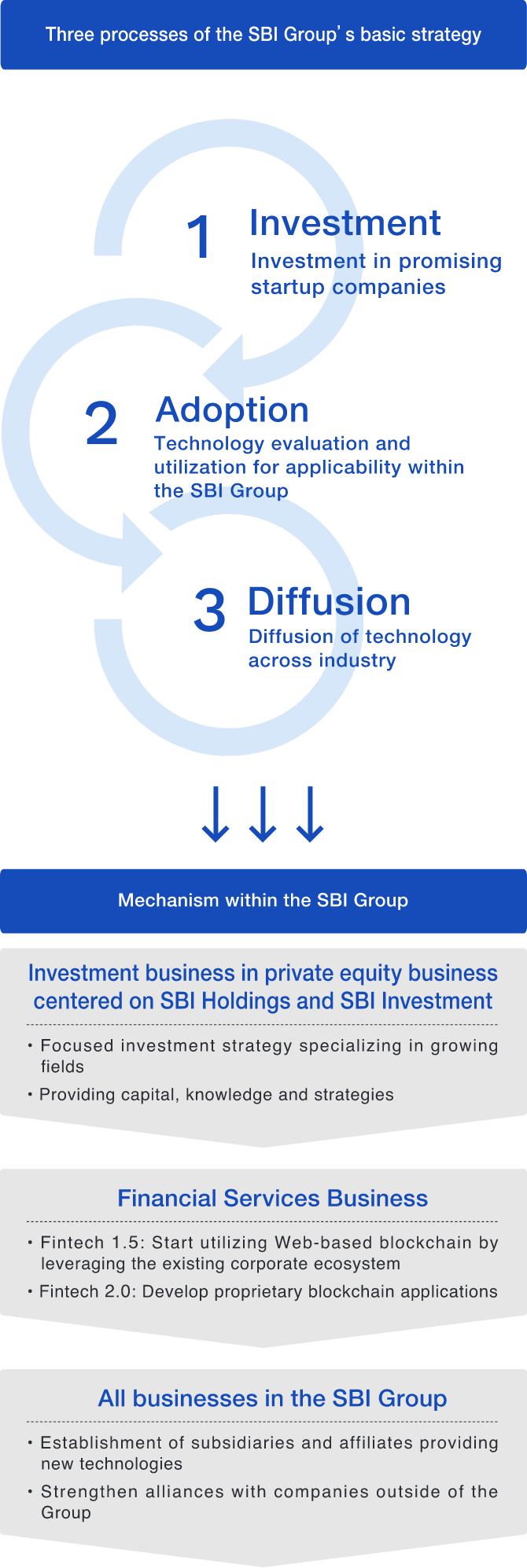

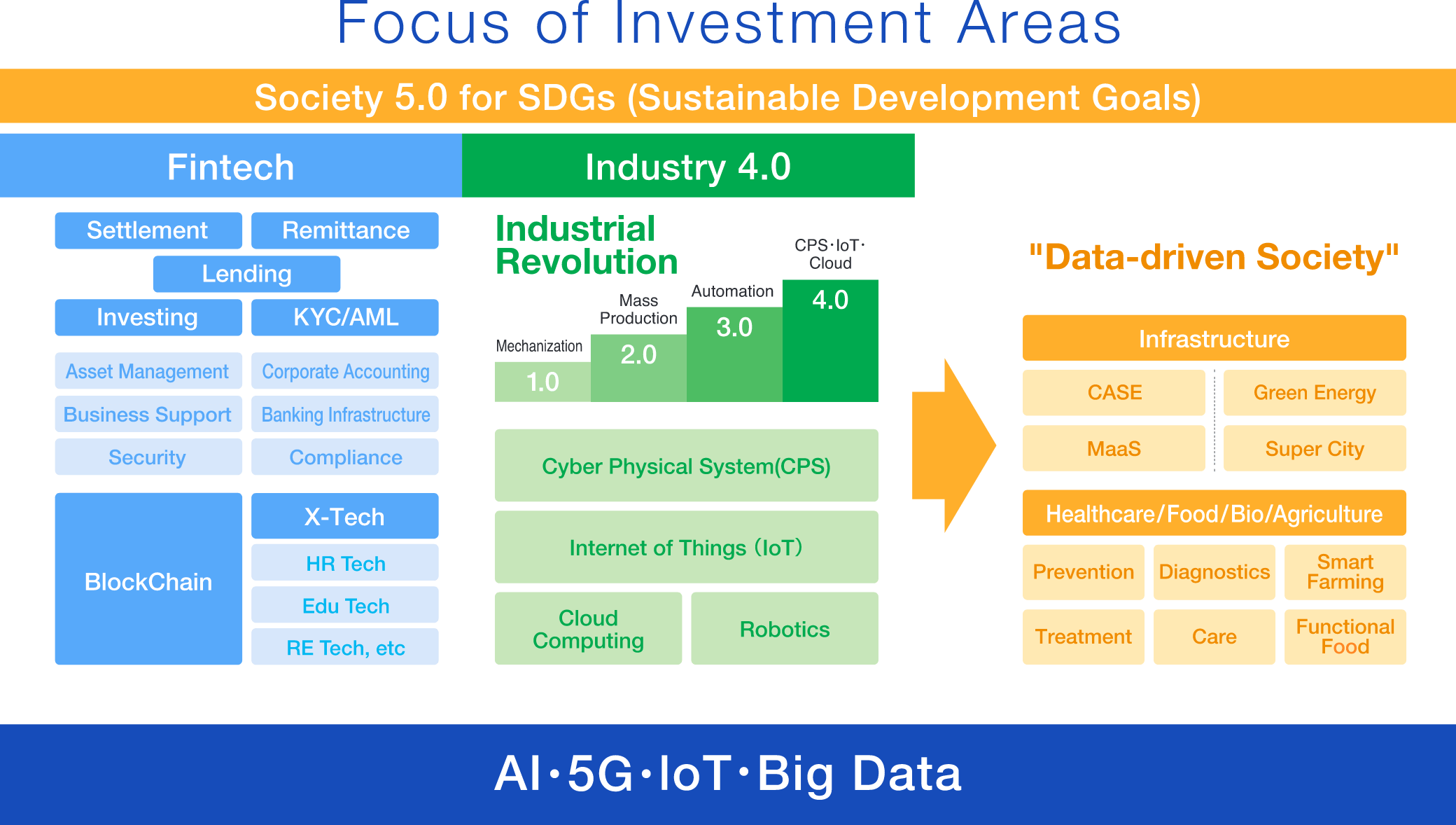

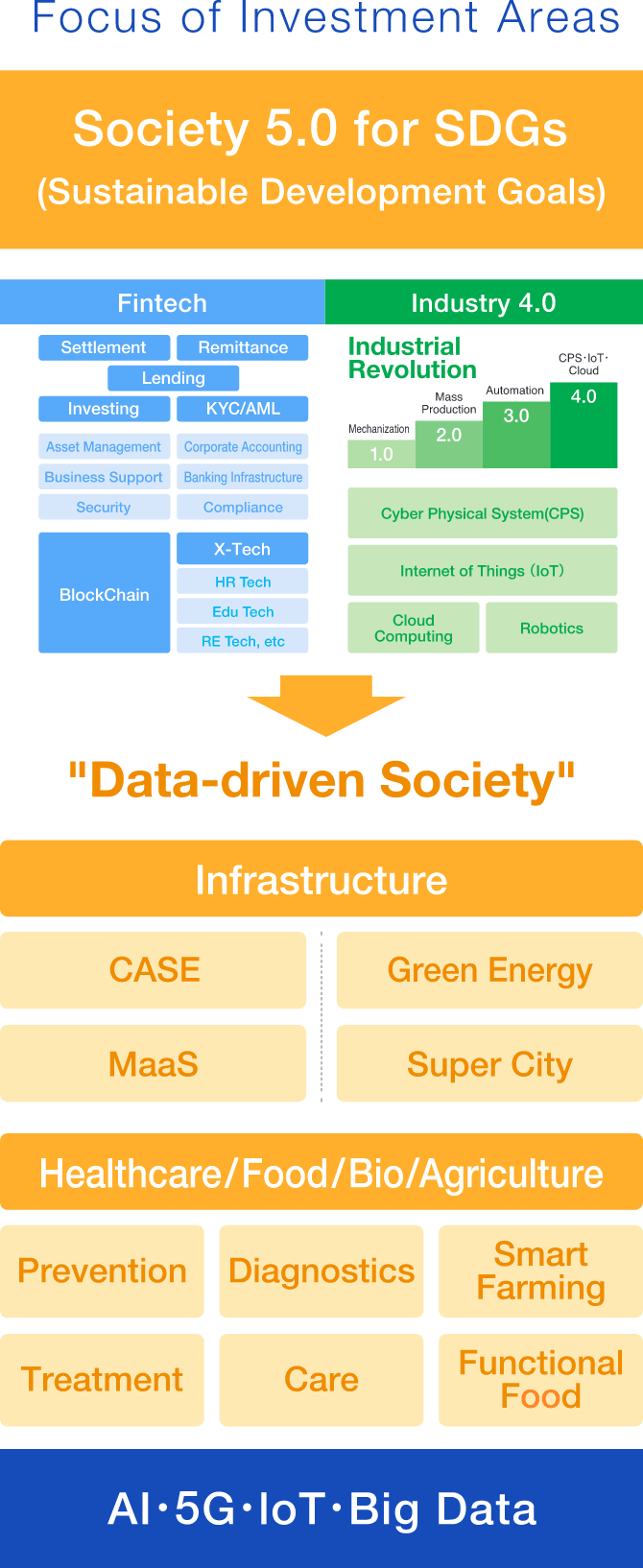

In January 2018, SBI Investment launched a JPY60B fund, whose main investment areas are AI and Blockchain, and has since invested in many promising startups globally. We are now supporting further growth with a hands-on approach.