Capability to Support Investees' Growth

We help our portfolio companies address their challenges by leveraging know-how obtained through our "Full Hands-on Support," to increase their corporate value.

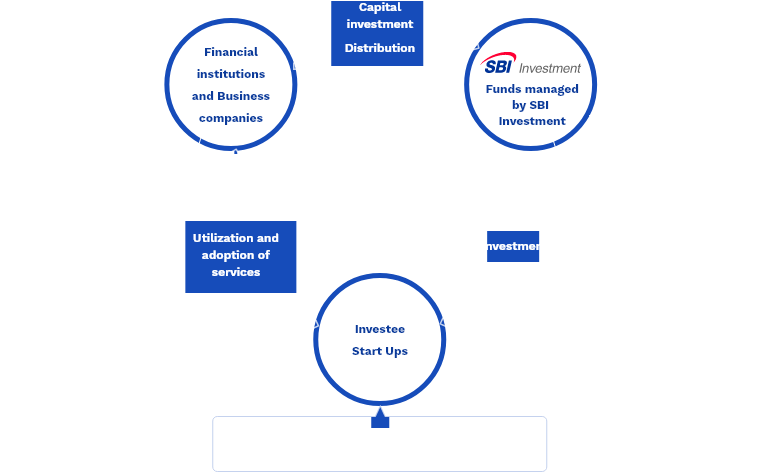

To enhance the corporate value of the companies in which it invests, SBI Investment proposes business tie-ups that make the most of the SBI Group's management resources and builds systems for consistent support through to investees’ IPOs.

For example, in addition to simply making investments, we promote the active use of the technologies and services of investee companies in a large ecosystem that includes the financial services companies of the SBI Group and investors in our funds, thereby contributing to improving the business performance of investees.

In addition, the SBI Group provides support for overseas expansion through its overseas network, formulates strategies tailored to investees’ business stages, dispatches officers, and builds internal control systems to actively support investee companies in a full hands-on manner, thereby making it possible to dramatically accelerate the speed of growth of investees.

We help our portfolio companies address their challenges by leveraging know-how obtained through our "Full Hands-on Support," to increase their corporate value.

The SBI Group leverages its customer base and external network for making referrals of customers and supporting a business alliance.

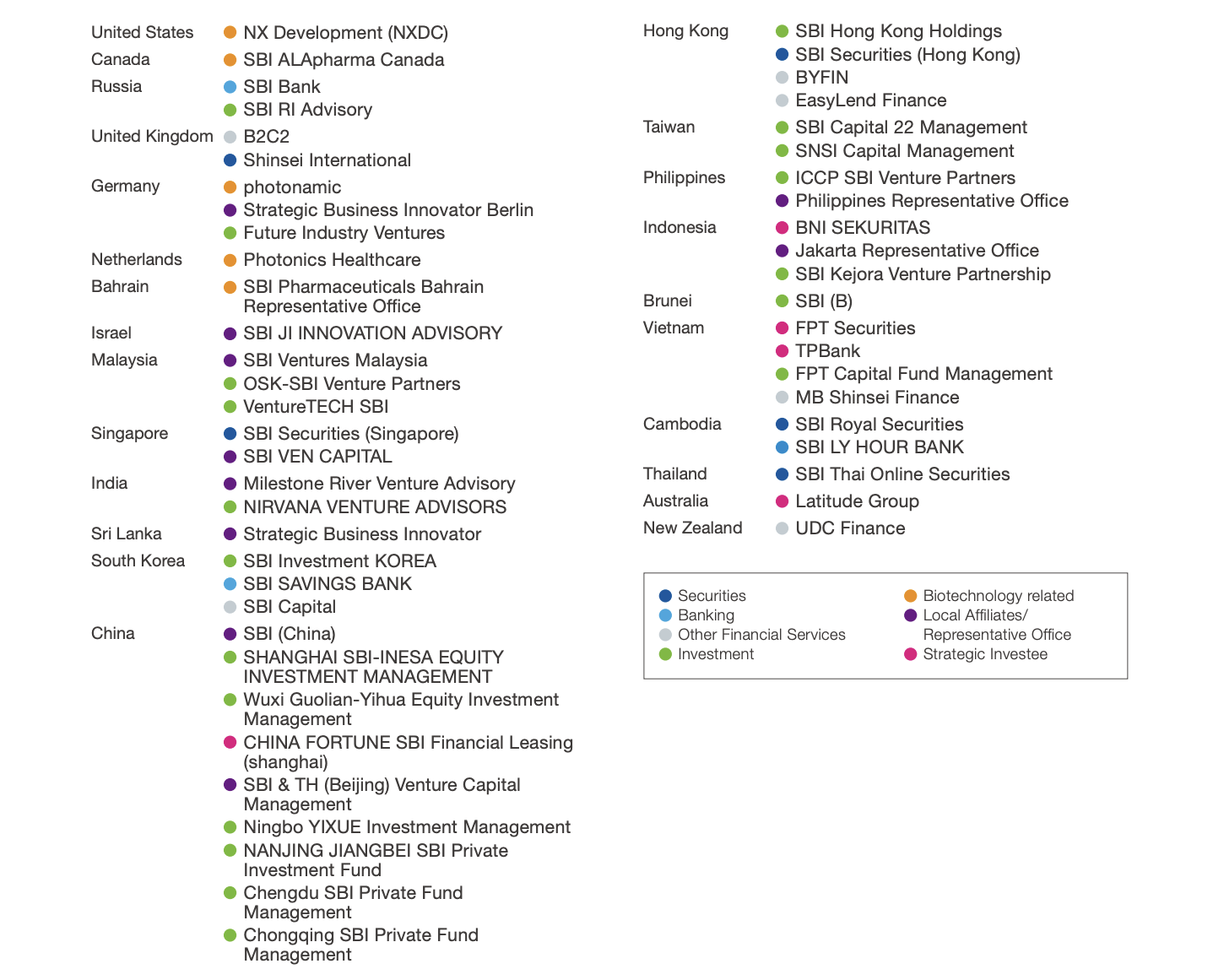

SBI Investment's network

Network of the SBI Group

* As of March 2022

SBI Investment provides support in formulating business plans and capital policies by dispatching officers from SBI Investment, and also provides support for sales, business development, and preparation for IPO by utilizing the resources of each SBI Group company.

We introduce overseas partners through SBI Group's overseas bases and support expansion of sales channels mainly in the Asian region by establishing JVs.

We establish joint ventures and provide sales support, such as expansion of sales channels, to overseas startups operating financial businesses with the potential to expand their business in Japan and the rest of Asia through use of resources of the SBI Group.

SBI Investment supports overseas expansion of investees by utilizing the SBI Group's overseas offices (overseas subsidiaries, representative offices, joint ventures, and capital tie-ups) and networks of local partners.