Domestic and Foreign Investment Records

We are actively investing not only in Japan, but also in Asia, the United States, and Europe.

Track Record

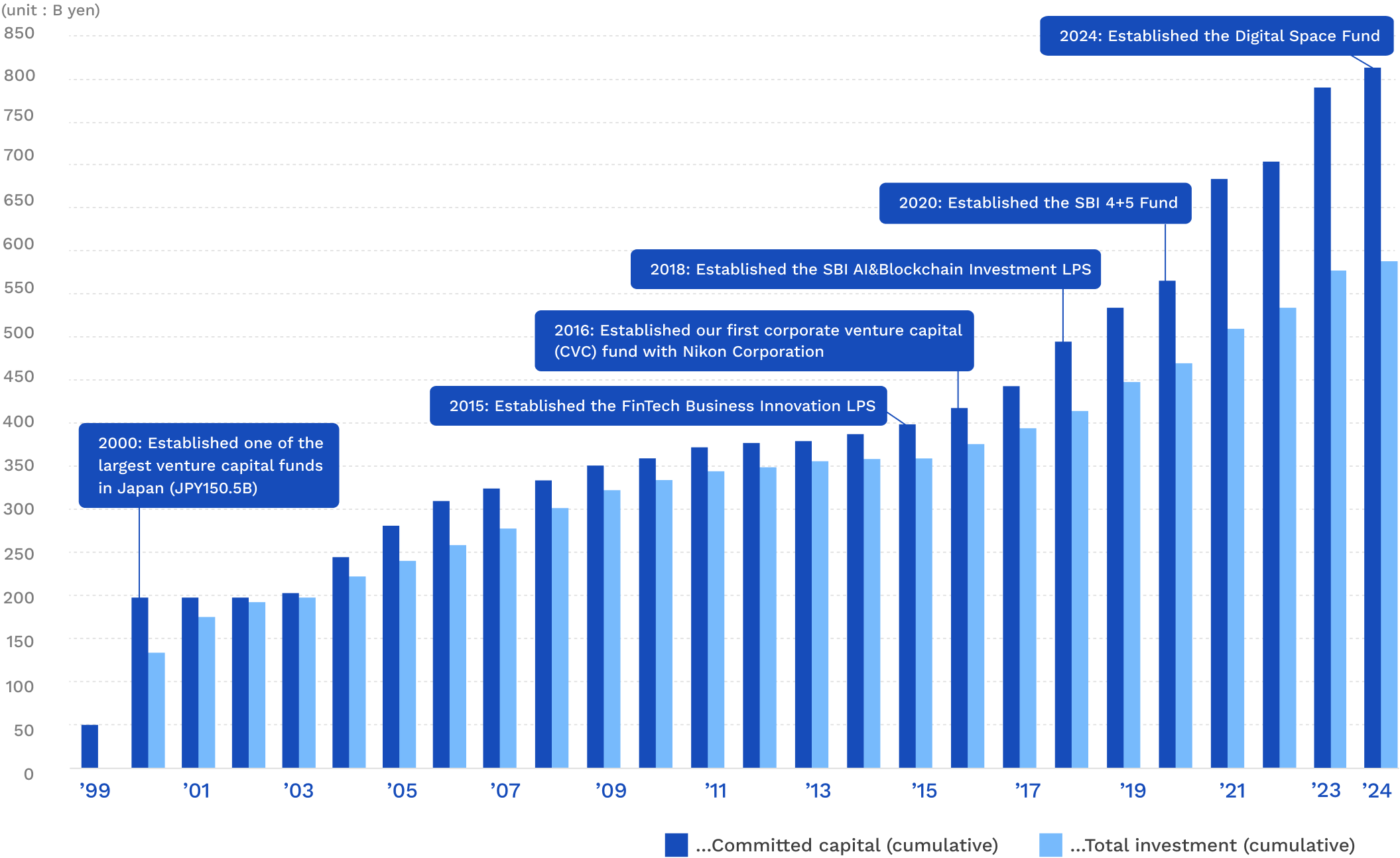

The accumulative number of portfolio companies

1,314companies(1,053 in Japan and 261 overseas)

Total Investment

JPY592.2B(cumulative)

Committed Capital

JPY825.4B(cumulative)

* As of March 31, 2025

Committed Capital and Total Investment

Corporate History

- July 1999

- SOFTBANK INVESTMENT CORPORATION established to undertake venture capital and incubation business

- March to July 2000

- Established the ‘Softbank Internet Technology Fund,’ one of the Japan's largest venture capital funds with a total size of JPY150.5B. This is a sector focused fund mainly targeting the internet sector The fund provides hands-on support with our in-house IT experts which is a differentiated factor from other venture capital firms.

- October 2004

- Established the ' SBI BROADBAND FUND No.1 Limited Partnership,' mainly for investment in companies related to broadband internet

- March 2005

- Established ‘SBI BB Media Investment Limited Partnership’ with Fuji Television Network and Nippon Broadcasting System

- July 2005

- On July 1st, along with several financial businesses, the fund management business spun off from SOFTBANK INVESTMENT CORPORATION and changed its trading name to SBI Holdings, Inc.

SOFTBANK CONTENTS PARTNERS CORPORATION and Biovision Capital Corp were consolidated under a new SOFTBANK INVESTMENT CORPORATION as an asset management business group.

- March 2006

- Established ' SBI BB Mobile Investment LPS ' focusing mainly on the mobile technology and content sectors

- October 2006

- Corporate name changed to SBI Investment Co., Ltd.

- July 2013 to

April 2015 - Established the 'SBI VentureFund No1~4 Investment LPS'

- December 2015

- Established the 'FinTech Business Innovation LPS' for investment in promising startup companies in the fintech business field

- July 2016

- Established the 'SBI Venture Investment Revitalization Tax System LPS'

Established a corporate venture capital (CVC) fund with Nikon Corporation

- October 2016

- Established a CVC fund with INTAGE HOLDINGS Inc.

- September 2017

- Established a CVC fund with Mitsui Mining & Smelting Co., Ltd.

- October 2017

- Established a CVC fund with House Foods Group Inc.

- January 2018

- Established the ' SBI AI&Blockchain Investment LPS' focusing mainly on the AI and blockchain sectors

- July 2018

- Established a CVC fund with SUBARU Corporation

- March 2020

- Established a CVC fund with FUSO Corporation

Established a CVC fund with dip Corporation

- April 2020

- Established the 'SBI4&5 Investment Limited Partnership' (a.k.a. 4+5 Fund) focusing mainly on 5G, IoT, Big Data, etc., which will contribute to the realization of "Society 5.0 for SDGs.”

- September 2020

- Established a CVC fund with Sumitomo Mitsui Trust Bank, Limited

- November 2020

- Established a CVC fund with Sumitomo Life Insurance Company

- March 2021

- Established a CVC fund with Medipal Holdings Corporation

- April 2021

- Established a CVC fund with Hankyu Hanshin Holdings, Inc.

- July 2021

- Established a CVC fund with Restar Holdings Corporation

- November 2021

- Established a CVC fund with KDDI CORPORATION

- July 2022

- Established a CVC fund with Panasonic Corporation

- September 2022

- Established a CVC fund with PARAMOUNT BED CO., LTD.

- January 2023

- Established a CVC fund with NIPPON EXPRESS HOLDINGS, INC.

- January 2023

- Established a CVC fundⅡ with House Foods Group Inc.

- April 2023

- Established a CVC fund with MatsukiyoCocokara & Co.

- September 2023

- Established the 'SBI Digital Space Fund'

- November 2023

- Established a CVC fund with Ricoh Company, Ltd.

Established a CVC fundⅡ with Nikon Corporation

- January 2025

- Established a CVC fundⅡ with Mitsui Mining & Smelting Co., Ltd.

- January 2025

- Established a CVC fundⅡ with Tokyu Fudosan Holdings Corporation.

- July 2025

- Established a CVC fund with Fukuoka Financial Group, Inc.

- September 2025

- Established a CVC fund with SANKYU INC.